Financing Sanitation, Paper Series I-4

The Financing Sanitation Paper Series is a unique collection of six articles about different aspects of sustainable financing of sanitation (in emerging markets) - from financial inclusion to private funding and from micro insurance to climate financing. The first paper in the series - An overview of the financial instruments for sanitation used in FINISH programmes in India and Kenya - was launched on the 11th of November 2015. The first copies were simultaneously handed over by Stefan Reuter (Director Borda, a partner of WASTE) to Graham Alabaster (Chief Basic Urban Services UN-Habitat) and by one of the contributors of the first paper, Theo Brouwers (Actiam) within the company. It is available on different websites (finishsociety.org, waste.nl) and is posted on several different forums.

As the papers are very close to our daily practices as they are written purely on the basis of our experience, insights and materials developed in our own sanitation programmes in India and Kenya. As you can imagine, financial engineering is not a theoretical exercise, therefore every article will be based on our practical experiences. This is also the reason why you will find no references in most of our articles. The articles have been written by different experts in the field of sanitation, financing and business development, each one of them passionate and at the same time closely connected to sanitation financing from different perspectives.

Contents

FINANCING SANITATION PAPER SERIES #1

An overview of the financial instruments for sanitation used in FINISH programmes in India and Kenya

The financial inclusion paragraphs of FINISH show a diversity which was not foreseen when the programme was initiated. During the Stockholm International Water Week 2015, I discussed our financial engineering activities in India and Kenya with a number of people (Pim van der Male (Dutch Ministry of Foreign Affairs), Sjef Ernes (Aqua4All) and David Wilcox (ReachScale). This discussion led to the idea to list the different financial instruments that we are using in the FINISH programmes in India and Kenya. A quick scan already produced a list of 17 financial instruments. After writing them down in detail, the list grew to over 30 instruments. Some of these are generally known, but many of them are relatively new - some even under development. It is our pleasure to present this overview and also the direction we are moving with the instruments that we are currently testing and finalizing. It is our hope that this will assist development partners in designing, financing and implementing sanitation programmes, projects and businesses and thereby contribute to achieving Sustainable Development Goal 6: ensure water and sanitation access for all. This short report provides an overview of the different financial instruments.

Microfinance

From the entire spectrum of micro finance (financial literacy, micro credit, micro savings, micro insurance and micro pensions) most instruments are used in FINISH in India and Kenya. The microfinance instruments could still be further detailed in loan types and amounts (whereby differences and similarities between countries become apparent) and also different types of insurance products on offer. Also we do not include micro pensions as it is not directly linked to the programme, though this is done by some of our partners.

Entire Paper Download: Financing Sanitation Paper Series #1 - An overview of the financial instruments for sanitation used in FINISH programmes in India and Kenya

FINANCING SANITATION PAPER SERIES #2

Financing Sanitation, The essence of public and private funding for sanitation

In this paper we describe actual cases in Ethiopia, India and Kenya. We are seemingly fond of acronyms as the experiences that are used here are drawn from the SPA, ISSUE-2 and FINISH programmes. Both the SPA and ISSUE-2 programmes had multiple objectives, financing being one of these. In the case of FINISH, financial inclusion is one of the two key objectives. The other being improved sanitation and densities of the same leading to better community health. In practical terms this implies that more quantitative data will be available from FINISH.

Many of the sanitation programmes including those above run on two premises:

1. Sanitation is a public good

2. People are willing to pay, but not all people have the capacity to pay

Realising that there are limited public funds available, can we identify mixtures of public and private financing that leverage limited public financial resources, attract other financial resources and target public resources to those most in need. The drawing below provides an overview hereof. Stratifying communities opens the possibility to design targeted/tailored financial instruments. The graph below shows on the left side the current scenario with many vulnerable people to a new scenario that is based on the ability to pay for sanitation investments and widens the “net” of private financing.

Entire Paper Download: Financing Sanitation Paper Series #2 - The essence of public and private funding for sanitation

FINANCING SANITATION PAPER SERIES #3

Deepening Financial Inclusion: The potential role of micro insurance in driving sanitation

In this paper we describe: (1) the possible role of micro insurance in development in general and in sanitation in particular; (2) the micro insurance work that we had done under FINISH, and (3) what we see as way forward particularly in relation to the FINISH programme in Kenya. This paper is the most difficult of the financing sanitation papers as we have experienced a rough and as of yet incomplete journey to achieve our objective of linking micro insurance to sanitation. Particularly as healthcare products limited to hospitalization somehow did not meet the FINISH requirements adequately. On the positive side, DGIS has been very supportive in our quest to make this vital link and we are not easily giving up on this ourselves.

Micro insurance

Microinsurance has a special place in financial inclusion as it protects wealth of low income people against specific perils in exchange for regular payments (premium) proportionate to the likelihood and cost of risk involved. It does this through sharing the risk in the target market so that premiums remain affordable yet equitable. In general, insurance is administered in two ways: Retailing individual insurance or through group insurance schemes. Both have their own nuances and their relative advantages and disadvantages.

Entire Paper Download: Deepening Financial Inclusion: The potential role of micro insurance in driving sanitation

FINANCING SANITATION PAPER SERIES #4

The relevance of a cheap motorbike for Sanitation: The bill of quantities in sanitation and the cheap motorcycle index

In this paper, we deal with the cost of sanitation and compare it to an alternative asset investment option: a (low cost) motorcycle.

The cheap Motorcycle Index

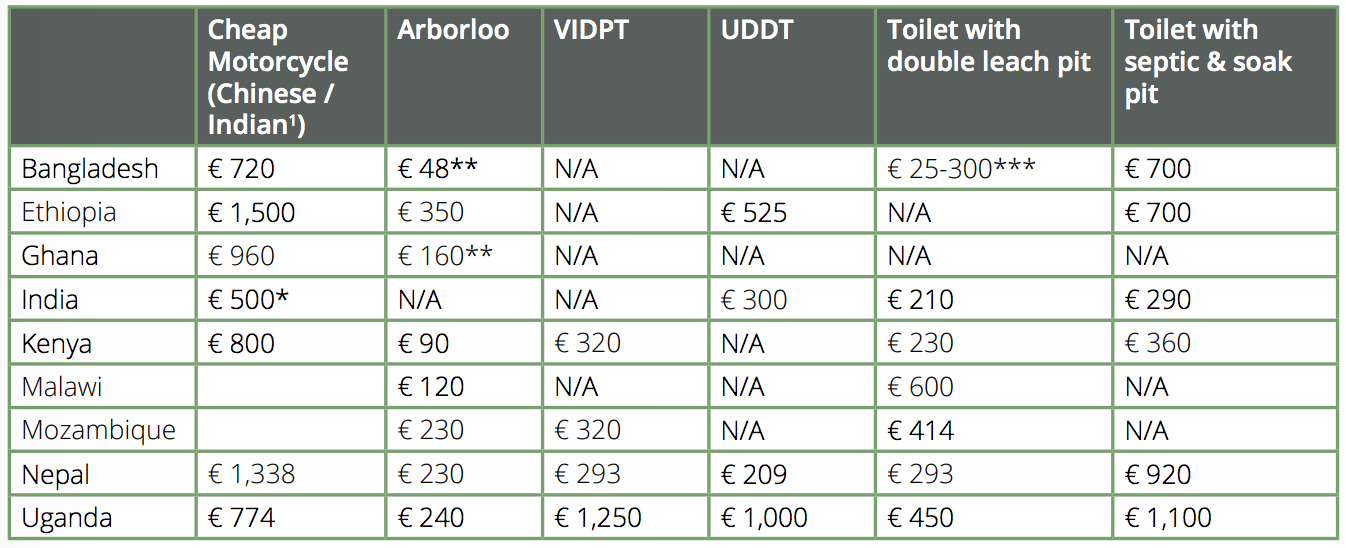

One of the most common means of transport in for instance Kenya or Uganda is a motor cycle. In view of its affordability, Chinese motorcycles have become the standard in Africa. With a given manufacturing cost in China and a known cost in shipping, local sales prices are an indicator of the state of the local economy. The resale value of the motorcycles is - just as in the case of sanitation systems - quite low. So, against this we are formulating our hypothesis: if your sanitation system (barring the arborloo and toilets linked to a biogas system) is half or less of the cost of a motorcycle, the sanitation system is well priced. Or, in other words, if two sanitation systems cost more than one cheap motorcycle, the emphasis needs to be on lowering the cost of the sanitation systems per se.

Chances are that:

- the dimensions of the system are not technically correct;

- erring on the side of over-cautiousness (engineered over-design);

- the cost of doing business is too high;

- profit margins are excessive.

This comparison offers a basic, though practical tool to evaluate costing.

Entire Paper Download: The relevance of a cheap motorbike for Sanitation: The bill of quantities in sanitation and the cheap motorcycle index