Difference between revisions of "Taxes"

(→Key documents) |

(→Links) |

||

| Line 49: | Line 49: | ||

===Links=== | ===Links=== | ||

| − | [http://www. | + | [http://www.ircwash.org/ IRC International Water and Sanitation Centre] is a knowledge broker, innovator and catalyst of change within the water, sanitation and hygiene (WASH) sector working internationally and in selected focus countries and regions. IRC seeks to extend WASH services to the less privileged, while ensuring that services are based on the sustainable use of water resources, are appropriately managed, and are better governed. IRC works in partnership with governments, the public and private sector, Dutch and international organisations, UN institutions, development banks and non-governmental networks and organisations. |

<div id="GLAAS">'''GLAAS'''</div> | <div id="GLAAS">'''GLAAS'''</div> | ||

[http://www.who.int/water_sanitation_health/publications/glaas_report_2012/en/index.html Global Analysis and Assessment of Sanitation and Drinking-Water (GLAAS)] is produced every two years by the World Health Organization (WHO) on behalf of UN-Water. It provides a global update on the policy frameworks, institutional arrangements, human resource base, and international and national finance streams in support of sanitation and drinking-water. | [http://www.who.int/water_sanitation_health/publications/glaas_report_2012/en/index.html Global Analysis and Assessment of Sanitation and Drinking-Water (GLAAS)] is produced every two years by the World Health Organization (WHO) on behalf of UN-Water. It provides a global update on the policy frameworks, institutional arrangements, human resource base, and international and national finance streams in support of sanitation and drinking-water. | ||

Revision as of 02:33, 17 May 2014

Taxes refer to funds originating from domestic taxes that are channelled to the water and sanitation sector via transfers from all levels of government, including national, regional and local (GLAAS, 2012).

Taxes are typically used as subsidies or grants, for capital expenditure or operational and minor maintenance expenditure. More hidden forms of these subsidies may include tax rebates (on toilet construction materials), soft loans, transfers from local government housing taxes, donations, subsidised inputs (electricity services) or dormant equity investments (Hervé-Bazin, 2012).

Subsidies from the national tax base include:

- Subsidies to local or national water operators

- Subsidies to infrastructure owners

Most lower-income countries do not collect enough tax at decentralised levels of governance to finance infrastructure construction, e.g. capital expenditure (IRC and WSUP, 2012). Most taxes in lower income countries are collected at national level and distributed to the different regions, according to an allocation formulae. Generally, allocations for water and sanitation are very limited (WHO, 2010).

Examples

Government expenditure on sanitation and drinking-water

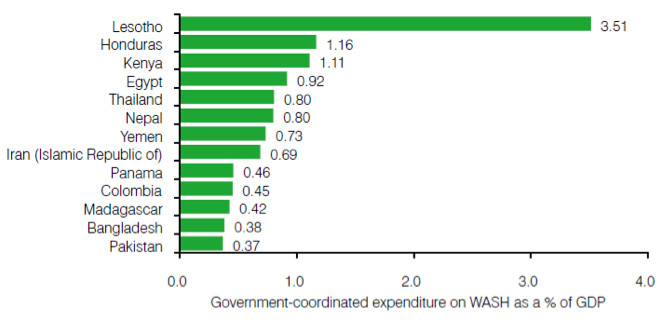

Government expenditure from taxes and transfers on sanitation and drinking-water ranged from 0.37% to 3.5% of Gross Domestic Product (GDP) (GLAAS, 2012, p. 28).

Figure 1. Public spending (from funds obtained through domestic taxes and external transfers)

on sanitation and drinking-water as a percentage of Gross Domestic Product (GDP) (2010 data)

India: Value Added Tax (VAT) on toilet pans

In India polypropylene toilet pans may cost INR 60 (US$ 1.25). However the Indian State Government of Kerala has added a Value Added Tax (VAT) of 4% on plastic pans charges and therefore polypropylene toilet pans cost US$ 1.30. For the more durable ceramic pans (which cost INR 150), the Central Government of India charges 12.5% VAT (US$ 3.10) (Mathew et.al, 2008).

Senegal: Social connection program

The government of Senegal actively supports the growth of both the water and sanitation sector through government subsidies. Often water infrastructure may exist, but low income households cannot afford the capital expenditure of connecting their household to the water line. Therefore the government of Senegal has started with Social connection; up to 85% of the cost of a household connection may be subsidized by the state through the social connection program. The Senegalese Government has sustained these programs over several years, leading to the dramatic increase in water coverage, especially in urban areas (Dibner-Dunlap, 2009). For example, 69% of all new household connections to the city water line in the city of Louga, between the years of 2001-2007, were done under the subsidy program. (Dibner-Dunlap, 2009, page 28).

Akvo RSR Projects

The following project(s) are utilizing taxation as a method of paying for water systems or services.

Integrated Community Water and Hygiene |

Key documents

- Dibner-Dunlap, A., et al, 2009. A review of local tax policy to expand water and sanitation access: prepared for WaterAid Madagascar and WaterAid America. New York, NY, USA, School of International and Public Affairs, Columbia University

- Hervé-Bazin, C., 2012. 3Ts: Tariffs, Taxes and Transfers in the European water sector: short guide. Brussels, Belgium: EUREAU

- IRC International Water and Sanitation Centre and Water & Sanitation for the Urban Poor (WSUP), (2012). Financing water and sanitation for the poor: six key solutions. Discussion paper. DP#003.

- UN-water global annual assessment of sanitation and drinking-water (GLAAS), 2012. The challenge of extending and sustaining services. Report. World Health Organization. ISBN 978 92 4 150336 5.

- OECD. 2009. Managing water for all: an OECD perspective on pricing and financing. Paris: OECD.

- Sijbesma, C., 2011. Sanitation Financing models for the urban poor. Thematic Overview Paper 25. [online] The Hague: IRC International Water and Sanitation Centre (Published November 2011).

- Mathew, K., Suma, Z. and Joseph, R., 2008. Preventing corruption, encouraging transparency and accountability in the water and sanitation sectors- a case study from Kerala, India. In: Wicken, J., et al., eds., 2008. Beyond construction: Use by all, A collection of case studies from sanitation and hygiene promotion practitioners in South Asia. [online] Delft: IRC International Water and Sanitation Centre, London: WaterAid, Dhaka: BRAC. [Accessed 10 November 2011].

- WHO and UN-Water, 2012. UN-Water global annual assessment of sanitation and drinking-water (GLAAS) 2012 report: the challenge of extending and sustaining services. Geneva, Switzerland: World Health Organization (WHO)

- Winpenny, J., 2011. Financing for water and sanitation: a primer for practitioners and students in developing countries. Stockholm, Sweden: The European Union Water Initiative Finance Working Group, EUWI-FWG.

Links

IRC International Water and Sanitation Centre is a knowledge broker, innovator and catalyst of change within the water, sanitation and hygiene (WASH) sector working internationally and in selected focus countries and regions. IRC seeks to extend WASH services to the less privileged, while ensuring that services are based on the sustainable use of water resources, are appropriately managed, and are better governed. IRC works in partnership with governments, the public and private sector, Dutch and international organisations, UN institutions, development banks and non-governmental networks and organisations.

Global Analysis and Assessment of Sanitation and Drinking-Water (GLAAS) is produced every two years by the World Health Organization (WHO) on behalf of UN-Water. It provides a global update on the policy frameworks, institutional arrangements, human resource base, and international and national finance streams in support of sanitation and drinking-water.