Budget Allocation and Resource Planning

If you or your organisation is preparing a proposal to apply for funds to carry out a project, there are a number of sections you will have to complete. However, what you do or do not include in the budget section of your application could be the difference between success and failure. In the following lines, you will find the principles of developing a budget, including the type of costs and how to calculate them. Furthermore, you will find tips on how to prepare a successful, honest and well-balanced budget, in line with the activities set in your project proposal. While local funding is considered to be the most sustainable, in this article we will focus more on the preparations of a budget as a sustainable item (insuring funding), and include both local and outside funding sources (as they should never be limited if needed).

A budget is defined as patterns of expenditure and revenue over the life of the project. In general, it is a prediction of the possible costs that will be incurred by carrying out the activities planned in a project. Realistic planning of finances is key to the implementation of a project or programme. A professional and transparent approach to budget planning will help convince investors, development banks and national or international donors to make financial resources available.

Generally, the budget has mainly two functions. First, it estimates, as realistically as possible, the cost of completing the objectives identified in the project proposal. The sponsoring agencies will use the budget details to determine whether the proposal is economically feasible and realistic. Secondly, the budget provides a means to monitor the project's financial activities over the life of the project. In this way, it is possible to determine how closely the actual progress toward achieving the objectives is being made relative to the proposed budget.

Many sponsors, especially government agencies and international organisations, provide either a form or a format for the budget. It is therefore imperative to follow the donor’s instructions explicitly. In fact, the first thing you should do is read the application guidelines carefully so you are sure of what you need to include — or exclude — in your budget.

In case there is not a specific guideline for the development of your budget, the following section will help you to prepare a realistic and well-balanced budget.

How to Start?

Before drawing up the budget, it is necessary to get an overview of the type of inputs needed to achieve the objectives of the project.

Typical categories may be, for example:

- people (such as researchers, consultants, other partners’ staff-time)

- travel costs (such as bus tickets, meal allowance)

- vehicles (such as rental, petrol, driver’s time)

- equipment (such as machinery, measuring instruments and other tools)

- consumables and supplies (such as material, pumps, bricks or containers)

- subcontracts (services and construction work)

Listing all the categories in columns in a spreadsheet application, such as Excel, will help you to organise your costs. As the budget should be in line with the activities set in the work plan, you should work through the narrative of the proposal identifying all the costs that must be incurred in order to carry out each single activity planned. In order to identify systematically the different expenditures, make sure you list all the activities in the rows of the same (Excel) table, where you previously defined of the costs categories.

Further Budget Development

Once you have identified the type of expenditures your project will have, the next step is to classify them according to standard budget categories. Budget items are generally divided into two classifications: direct costs and indirect costs. According to the European Commission (EC 2009) “direct costs are all those eligible costs which can be attributed directly to the project and are identified by the beneficiary as such, in accordance with its accounting principles and its usual internal rules”.

Direct costs can be:

- Personnel costs: They should reflect the total remuneration, including salaries plus social security charges (holiday pay, pension contribution, health insurance, etc). Usually, the personnel costs are calculated in terms of ‘man days’ or ‘man months’ of junior, medium and senior grade persons. You will have to identify the productive hours per employee per year to compute the hourly rate, and these should exclude annual leave, public holidays, weekends and sick leaves.

- Travel and subsistence allowances: First determine what travel expenses the granting agency will allow, and then itemise the cost of each trip, e.g., round-trip airfare, lodging and meals, taxis, visa, etc. You can plan the reimbursement of the costs to your employees based on actual costs or a lump sum or per diem payment. This last can be calculated through a simple addition of the possible costs that one employee might have spending one day (with and without night) outside his/her residential area.

- Vehicles: Usually, this cost will be included in the travel and subsistence item. You will need to consider the costs of renting or maintaining a car for the purposes of the project. If you plan to drive your own car, you may claim a certain amount per mile.

- Durable equipment: Any item which will retain its usefulness beyond the grant period is considered capital equipment. Funding agencies have different views on the purchase and maintenance of equipment, so be sure you know the policy of the agency before including such costs in your budget.

- Consumables and supplies: Include enough supply money for all activities in the project. Typical consumables are stationary, duplicating supplies, typing/computing supplies, and software.

Indirect costs

Indirect costs are all those eligible costs which cannot be identified by the beneficiary as being directly attributed to the project, but which can be identified and justified by its accounting system as being incurred in direct relationship with the eligible direct costs attributed to the project. Indirect costs, also called overheads, Facilities & Administrative Costs, typically are costs of operating and maintaining buildings (electricity/gas/water bills), grounds and equipment, depreciation, general and departmental administrative salaries and expenses and library costs.

Rules for determining the overhead in a funding programme is usually given by the donor, so be sure to find out what percentage, if any, the funding source will allow for indirect costs, and determine which portion of your budget the percentage applies to. Sometimes indirect costs are a percentage of the total direct costs, or of the personnel costs, or of the salary and wages item alone.

When you are determining the actual rate of the costs related to your action, be as close to reality as possible. It is important that the budget is compiled in close cooperation with staff from the financial department, so you would obtain realistic numbers.

| To continue reading check out the complete guide, Budget Allocation and Resource Planning, on the SSWM website. A Power Point is included. |

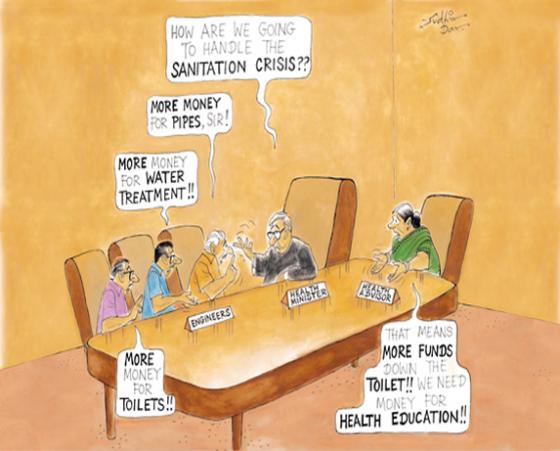

Budget tracking

Budget tracking is a possible way forward towards accomplishing the objectives of the two leading principles of the FIETS: financial sustainability and institutional sustainability. Budget tracking is needed to make sure funds from the national level will reach the right beneficiaries. Lobby at national and international level should convince public and private stakeholders to invest in and create an enabling environment for WASH services.

PETS

Public Expenditure Tracking Surveys (PETS) are the most common form of budget tracking used by the World Bank. Here you can download a document about PETS and budget tracking. This Briefing note was written by IRC (International Water and Sanitation Centre). It was presented and discussed with DWA members during the Workshop: Finance for WASH, Learning from Practice, held in Leiden, The Netherlands, February 2012.

Acknowledgements

- Leonellha Barreto Dillon, Budget Allocation and Resource Planning. SSWM.

- Financial Sustainability. Dutch WASH Alliance.